How to Handle Notifications of Change (NOCs)

A notification of change (NOC) occurs when the bank sending funds notifies the bank receiving funds that some portion of the once-valid information has changed. This could result from a bank buying another bank, which would cause routing numbers to change. With NOCs, ACH transactions will run successfully, but your business will incur a fee. These notifications of change are inevitable, but they could eat away at your profits if you’re not with the right provider.

Common Notifications of Change

These ACH rejects are specific to bank account information, meaning something about the account has changed. The following are the two most common NOCs businesses run into:

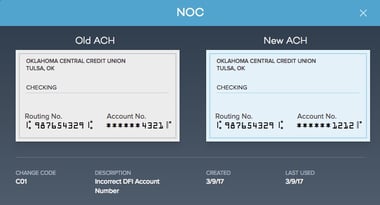

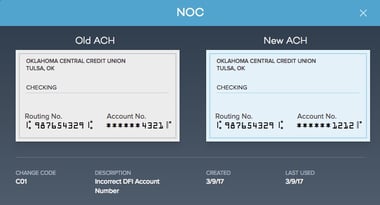

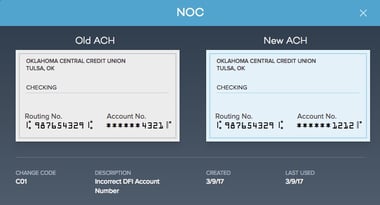

- CO1 Incorrect Bank Account Number – The bank account number is incorrect or is formatted incorrectly. This occurs when an account number changes and an ACH transaction is run with the old information. It’s possible the customer had to change the account number, perhaps due to fraudulent activity, and failed to notify you of the change.

- CO2 Incorrect Transit/Routing Number – The once-valid transit or routing number must be changed. This NOC occurs because the routing number is no longer valid. This typically occurs because the bank that holds the ACH account being debited has reorganized its routing numbers. It’s also possible a customer has moved and adopted a new local bank, which triggers routing numbers to change.

Notifications of change can have a significant financial impact on your business. Most Merchant Account Providers charge a fee for every NOC, so they have an incentive to not notify you of changes.

Payment Processing Demo

Schedule 15 minutes with a payments expert

Get a customized PayJunction product walk-through

Understand requirements and pricing

Determine your SAVINGS!

Handling Notifications of Change

In a perfect world you wouldn’t receive any notifications of change, but that’s not realistic. Here’s a few best practices to follow when it comes to notifications of change:

- Work with a provider with the best technology. Getting charged for every NOC you encounter is unfair, especially when your provider fails to assist you in resolving the change. With a top-notch Virtual Terminal, information is auto corrected when a NOC comes through, so the next time around it runs correctly and you don’t incur further fees. For example, if an account number has changed, but the routing number remains the same, the system corrects the account number.

- Always charge from the customer contact. When you recharge a customer, it’s best to charge from her account on file, and not a previously ran transaction. Information will update on the customer contact, but not an old transaction. If you rerun a transaction with old information, you’ll give yourself a NOC and incur a fee.

Familiarize yourself with common notifications of change and these best practices so you are ready for the inevitable. Opting for a provider that offers a superior Virtual Terminal can save you headaches and the hefty bills that many businesses unfortunately run into with NOCs.

Know these 4 common ACH error codes.

Do you encounter NOCs often as a business owner? What's your current process of addressing them? We'd love to hear from you.