Understanding journal entries for invoices will help you keep your financial records accurate. But we understand that maintaining a tidy financial record can be quite overwhelming, especially for beginners.

So here’s how to record invoices in accounting. Today, we will explore basic terms related to accounting, ways of recording, and more. So let’s begin.

Table of Content

Every transaction creates both accounts payable and accounts receivable for the customer and the vendor, respectively. So to get a better understanding, let’s discuss what Accounts Payable and Accounts Receivable are and the difference between them.

Here are the differences between them:

| No. | Accounts Payable | Accounts Receivable |

| 1. | It is the money you owe to other businesses, suppliers, or creditors for any purchased goods or services. | It is the money others owe to you for any purchased goods or services. |

| 2. | It depicts a current liability. | It depicts a current asset. |

| 3. | It is a cash outflow. | It is a cash inflow. |

| 4. | It consists of vendors’ records. | It consists of clients’ records. |

Automate Your Accounting

Create invoices and send automatic reminders with InvoiceOwl.

Businesses engage in many transactions and need a distinct set of journal entries. Therefore, they customize their invoice recording process as per their needs. Here are a few ways most businesses record their financial transactions.

For many businesses, their revenue journal entry can be split into two main categories: sales accounts and allowance for doubtful accounts.

When the customer pays later, the entry can be reversed by entering the debit amount as the accounts receivable and crediting the bad debt expense. You can then issue a receipt to the customer by debiting the cash account and crediting the accounts receivable.

For owed expenses, the applicable expense account will be debited by the appropriate debit amount while the cash or accrued liability account will be credited.

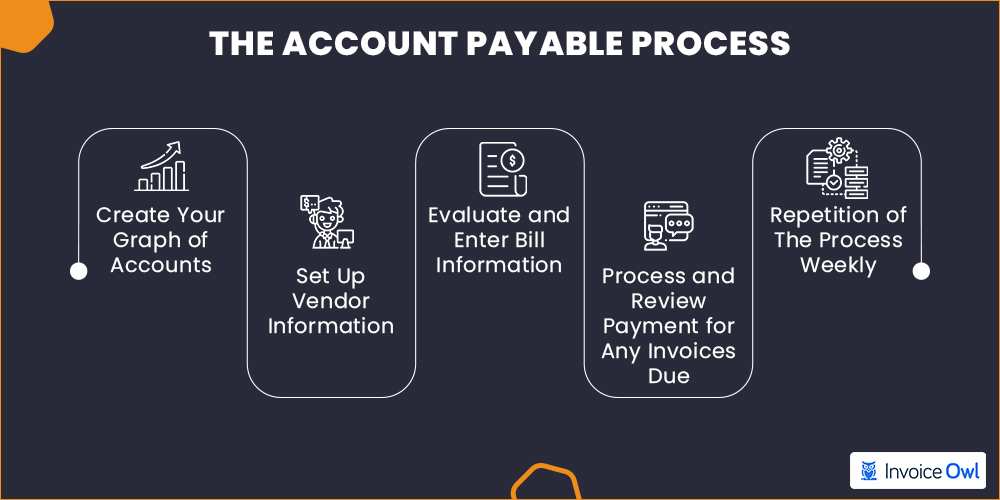

The accounts payable process in an organization is the management of its short-term payment obligations and covers everything from paying vendors and suppliers for goods and services purchased to managing and verifying incoming bills and invoices.

For most organizations, the accounts payable process can be split into four steps:

Having an accurate account payable is not only essential to producing an accurate balance sheet, but it also indicates whether you are overspending or relying too much on credit. Also, a decrease in accounts payable indicates negative cash flow, which can help you detect an inventory that could be tying up cash in your bank account.

Regardless of the company’s size, the accounts payable would only pay invoices and bills that are accurate and legitimate. So before an invoice is entered into your accounting records, the invoice must clearly itemize what was ordered, what has been received as well as the unit and total costs.

Most organizations employ safeguards like using invoicing software to ensure all vendor invoices are accounted for and to prevent:

Here are a few features of a functional accounts payable process:

Without optimizing your accounts payable system, you end up stalling the growth of your business. Here are some of the best practices for AP departments globally.

Here is our guide on how you can digitalize your invoices.

Tired of Paper Invoicing?

InvoiceOwl helps you create and manage electronic invoices efficiently.

Recording an invoice is a tiresome process. This is why most growing organizations hire an accountant. And even with the perfect general ledger recording process, there could be lots of errors.

When running a business where multiple transactions are happening simultaneously, these errors can cost you a fortune which is why many organizations use accounting software that can be tailored to their operations.

InvoiceOwl helps small businesses manage their income and streamline their bookkeeping process. Create multiple types of invoices online and manage your clients effortlessly. With the power of cloud computing, bookkeeping has never been easier.

Try Invoice Owl for FREE to create professional invoices and collect payments online.

Author Bio Jeel Patel FounderJeel Patel is the founder of InvoiceOwl, a top-rated estimating and invoicing software that simplifies the invoicing and estimating processes for contractor businesses. Jeel holds a degree in Business Administration and Management from the University of Toronto, which has provided him with a strong foundation in business principles and practices. With understanding of the challenges faced by contractors, he conducted extensive research and developed a tool to streamline the invoicing and estimating processes for contractors. Read More

Get weekly updates from InvoiceOwl.