Absorption costing is a tool used in management accounting to capture entire expenses connected to manufacturing a certain product. For external reporting, generally recognized accounting principles (GAAP) demand absorption costing.

Moreover, it is a costing process for valuing inventory. It’s also known as complete costing because it accounts for all direct manufacturing costs, including labor, raw materials, and any fixed or variable overheads.

Fixed and variable selling and overall administration costs are treated as period costs in absorption costing, and they are expensed in the period in which they occur; they are not included in the cost of production.

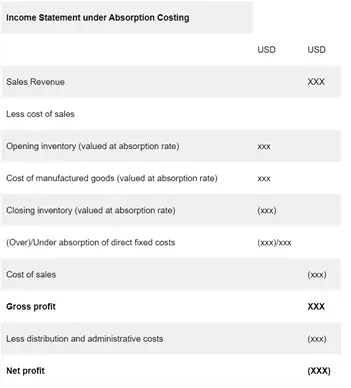

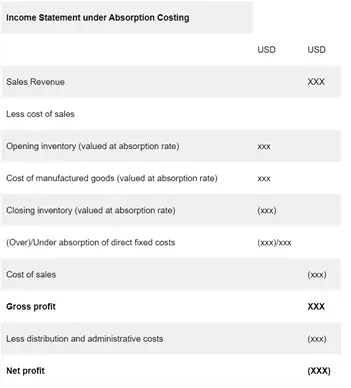

The traditional income statement, also known as the absorption costing income statement, is created using absorption costing. Costs are divided into product and period costs in this income statement.

See also Accounting For Security Deposits – Refundable Cash DepositsAbsorption costing states that every product has a set overhead cost, regardless of whether it is sold or not during a certain period. This means that all costs must be included at the end of an inventory, which is normally done as a balance sheet asset.

As a result, when using an absorption statement, it is common to find that the expense on the income statement is smaller.

Administrative, selling and manufacturing costs are all separated into three categories by absorption costing.

Category 1: In order to calculate gross margin/gross profit on sales in the income statement, all production expenses, both fixed and variable, are deducted from the sales revenue.

Category 2: The net operating income is found by subtracting the variable and fixed administrative and selling expenses from the gross profit/gross margin.

Category 3: Fixed factory or manufacturing overheads are charged to the units produced at a predetermined fixed manufacturing overhead rate.

The fixed manufacturing overhead rate is calculated using the formula:

= (Standard fixed manufacturing overheads / Normal level of output)

Adjustments are made for the level of output differences if the actual output level is higher or lower than the normal output level. The amount of over-absorption is deducted from the total cost of items created and sold if the actual output level exceeds the typical output level.

The amount of under-absorption is added to the cost of items created and sold if the actual output level is less than the normal output level.

The most basic approach is to represent gross profit as sales minus the cost of items sold. Also, indicate the operational income equal to the gross profit minus the selling and administrative expenses.

See also Accounting for Issuance of Common Stock: Example, Journal Entries, and More

According to accounting tools, the primary item on an absorption income statement is gross revenues for the period. The cost of products sold is next. To calculate COGS, add the cost of products produced for the time to the dollar worth of initial inventory.

The resulting figure represents commodities for sale. The cost of goods sold (COGS) is calculated when the ending inventory dollar value is subtracted. To get the gross margin, minus gross sales from the cost of goods sold. To compute net operating income for the period, subtract selling expenses.

By means of this technique to determine profits, no distinction is made between variable and fixed costs. As the absorption costing statement assumes that products have fixed costs, all manufacturing costs must be contained within the creation cost, whether variable or fixed.

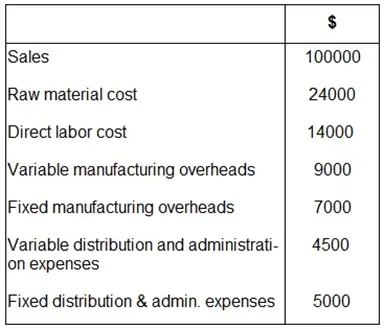

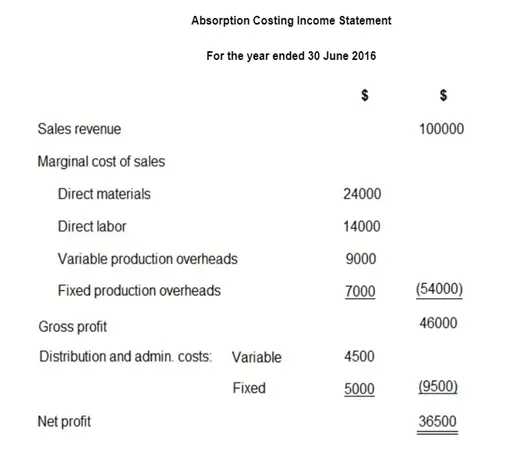

A company sells ice cream. The following data is available for the fiscal year ending June 30, 2016.

Since it is the generally acknowledged type of accounting idea needed by the Internal Revenue Service, absorption costing offers an advantage over other account formats; however, there are a number of reasons and benefits to absorption costing, including but not limited to:

Overall, this statement is much easier to make if you understand product and period costs. Calculate the unit cost first, as that is the most difficult portion of the statement. The rest of the statement is simple once you have the unit cost.